Financial scams can happen to anyone, regardless of their age, income, or level of education. These scams are designed to trick people out of their hard-earned money, often leaving victims in a difficult financial situation. However, there are several ways to protect yourself. Here are six tips on how to protect yourself from financial scams.

Look closely at phishing/scam emails

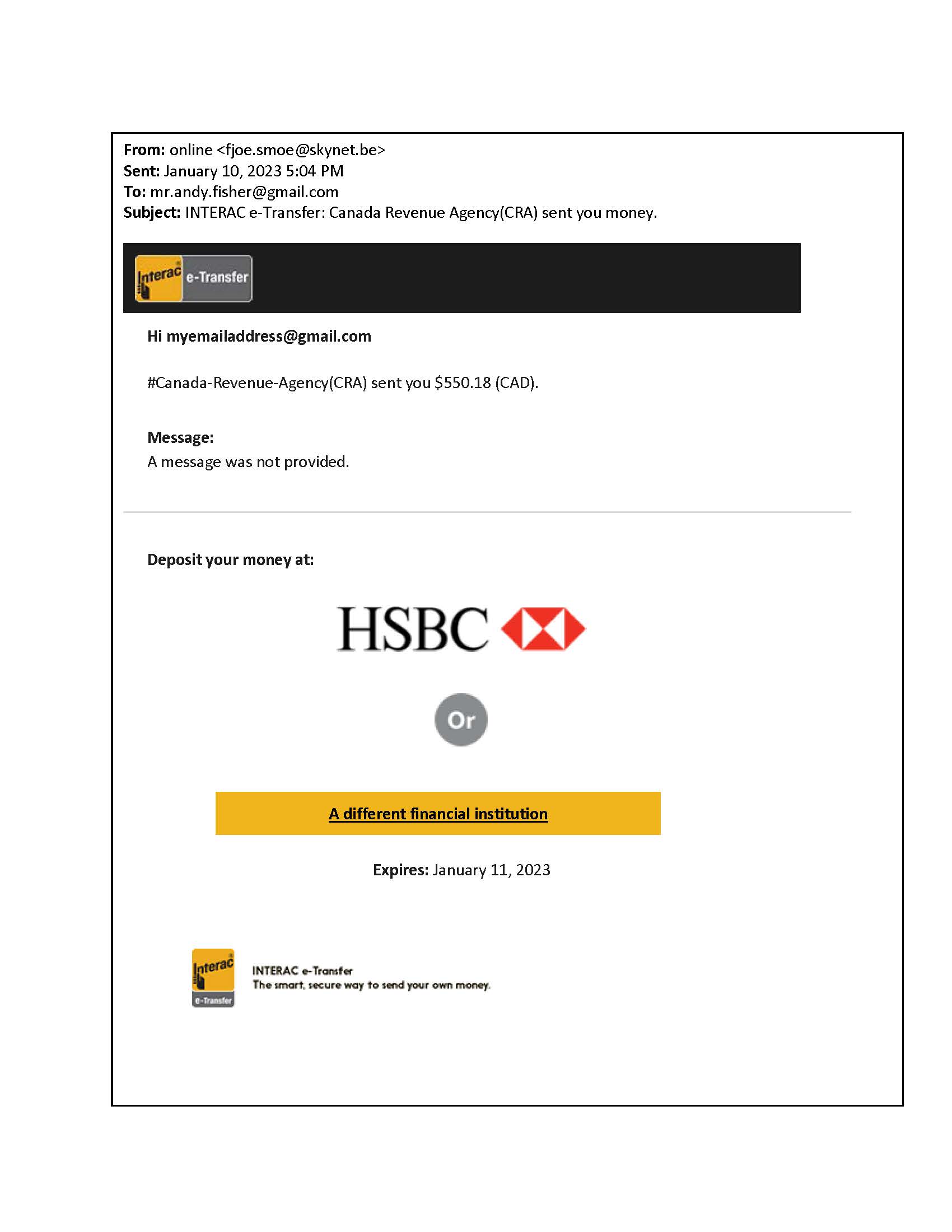

Phishing or email scams are the most common financial scams that often catch people. Look closely at the email before you click on any links or open any attachments. If you see a lot of typos, or if the graphics or logos in the email don’t look right, it’s probably a scam. Whether the email is from a company, organization or a friend, look closely at the email address of the sender. If it doesn’t look like it’s coming from the company or friend that is purporting to send the email, it’s probably a scam.

Set out below is an example of a phishing email. If you look at the email address from the sender, you can see that this is not from CRA or from HSBC.

Calls from CRA

We have all received spam/fraudulent phone calls from someone purporting to be from CRA demanding payment. If you get one of these calls, hang up right away. CRA will never call before they’ve contacted you by mail and give you a contact person for you to call. They never take a payment by credit card, bitcoin or cryptocurrency. CRA will also not ask for your banking information, address or Social Insurance Number over the phone; they already have most, if not all, of this information already.

Text scams

A common technique of scammers is to send a text pretending to be from your bank. The text will say that you have an e-transfer and ask you to click a link to deposit the funds. These texts are often from an institution that you don’t bank with, but sometimes these texts look like they’re coming from your bank. Banks will not text you that there is an e-transfer. If you’re not set up for auto-deposit, you’ll get an email regarding the e-transfer where you’ll be asked to answer the security question that the person sending the funds set up. CRA doesn’t send payments by e-transfer. The bank will never ask you to confirm your banking information or Social Insurance Number, as they already have that information. The best way to avoid these types of scams is to set up auto-deposit for e-transfers. That way you’ll know any text with a link to deposit an e-transfer is a scam.

Protect your personal information

Protecting your personal information is crucial in avoiding financial scams. Scammers may use your personal information such as your name, address, and social security number, to steal your identity or access your bank accounts.

To protect yourself, never share personal information online or over the phone unless you are certain of the identity of the person or organization requesting the information. Use strong passwords and two-factor authentication to protect your online accounts. And when disposing of financial documents, be sure to shred them first to prevent anyone from accessing your personal information.

Also, make sure the Wi-Fi you’re using is safe. Avoid logging into your bank using public Wi-Fi locations.

Review your bank accounts and credit card transactions regularly

Review your bank account and credit card transactions regularly to make sure there aren’t any charges that you don’t recognize. If you don’t recognize a charge, google the name to see if it is a legitimate charge. If you don’t recognize the charge, call you bank immediately to discuss the issue. Often scammers will steal personal information and charge smaller amounts that may not get noticed. This will allow them to steal money from you for many months.

Be skeptical and trust your instincts

If you get an email or a text from someone you don’t recognize, or if the offer seems too good to be true, it’s probably a scam. If you’re contacted by someone and it doesn’t feel right, it probably isn't. Trust your instincts. And if you’re getting a phone call, don’t let scammers pressure you into making a quick decision or providing personal information.

Financial scams are a serious threat to your financial wellbeing. Scammers use sophisticated techniques to get your personal information to steal from you or steal your identity. By being skeptical, protecting your personal information, and trusting your instincts, you can protect yourself from scams and avoid being the victim of financial fraud.