CAIRP: Q4 Canadian Insolvency Statistics

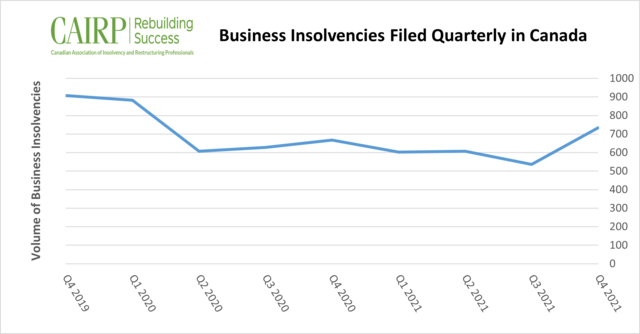

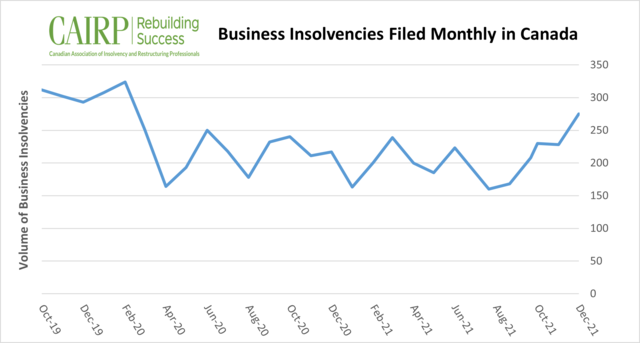

TORONTO – February 4, 2022 – The number of Canadian business insolvencies jumped 36.8 per cent in the fourth quarter. It was the largest rate of increase in 35 years of records tracked by the Office of the Superintendent of Bankruptcy. The surge in insolvencies could signal the beginning of a rebound back towards pre-pandemic levels, according to the Canadian Association of Insolvency and Restructuring Professionals (CAIRP).

“After nearly two years of record-low business insolvencies, the persistent uncertainty caused by the COVID situation is now forcing difficult decisions from Canadian business owners who are operating in the face of increased costs, supply chain issues and a tapering of pandemic-related government support,” says Jean-Daniel Breton, Chair of CAIRP, which is the national voice on insolvency matters in Canada.

A total of 733 business insolvency proceedings were filed under the Bankruptcy and Insolvency Act in the fourth quarter of 2021, down 19.2 per cent compared to the pre-COVID fourth quarter of 2019 and up 9.7 per cent compared to the same quarter in 2020. For the 12-month period ending December 31, 2021, business insolvencies are down 11 per cent compared with the 12-month period ending December 31, 2020.

“The figures do not tell the whole story because owners of small, fragile companies that were surviving through low-interest rates and government support may decide to walk away rather than consider insolvency or restructuring options,” explains Breton.

He points out that revenues have not returned yet for many businesses. Those that were propped up by COVID-19 support measures or became heavily indebted during the pandemic are at high risk of default.

The pressures of inflation, declining revenues and increasing debt-servicing costs make paying back COVID-incurred debts while covering the costs of running the business even more challenging.

“Struggling businesses may be under the mistaken notion that their only next course of action is shuttering their doors. But walking away isn’t always the only or best option. Just as these business owners adapted and pivoted to make it through the pandemic, there may be options to restructure or rehabilitate to make the business viable again with the right guidance from a Licensed Insolvency Trustee,” he says.

“Shutting down operations without seeking professional guidance can have lasting financial impacts for employees and business owners. Don’t wait until you’ve completely run out of time and money to get advice.”

The sectors registering the biggest decrease in the number of insolvencies were the retail trade and accommodation and food services sectors. The biggest increases were seen in the construction; and transportation and warehousing sectors.

Consumer insolvencies increased slightly in the fourth quarter, remain below pre-pandemic levels

The number of individuals who filed an insolvency proceeding increased slightly in the fourth quarter but remained far below pre-pandemic levels. With 22,266 individuals filing bankruptcies or proposals, quarterly insolvencies were up 5.5 per cent compared to the previous quarter but down 4.7 per cent compared to the same period in 2020 and down 36.7 per cent compared to 2019.

“We may not start to see consumer insolvencies return to pre-pandemic levels until later in 2022, as the tightening of monetary policy and interest rate hikes apply pressure to personal finances,” says André Bolduc, Vice-Chair of CAIRP and a Licensed Insolvency Trustee.

For Canadians who were already struggling financially and then became reliant on government pandemic support to stay afloat, another crisis looms – mounting household debt and increasing debt servicing costs. Bolduc advises those in this situation to seek professional debt help from Licensed Insolvency Trustees (LITs).

"Be wary of debt settlement and credit repair schemes that may falsely promise to slash your debt or ask for a large fee up-front. LITs are the best first point of support for anyone in severe financial difficulty because we are the only professionals in Canada who can negotiate agreements that bind all creditors and offer debt-relief options including consumer proposals and bankruptcy,” says Bolduc.

Common warning signs that an individual should seek debt help include anticipated missed payments on loans, collection letters and phone calls from creditors.

LITs are the only professionals who can offer legal protection from creditor actions and stop collection calls and wage garnishments. Consultations are free and, because LITs are federally regulated, they are required by law to offer a complete assessment, explain all the options for debt-relief and offer unbiased advice.

Image Inclusions:

Graphs: Fourth quarter 2021 surge in business insolvency filings could signal the beginning of a rebound back towards pre-pandemic levels.