Rebuilding Success Magazine Features - Fall/Winter 2024 > A Career Like No Other in the Financial Sector

A Career Like No Other in the Financial Sector

|

By Andrew Flynn

Public perception of insolvency and restructuring professionals has long been unduly focused on the negative. They spring from a misperception that bankruptcy is a shameful thing, the worst financial situation in which a person or business can find themselves, a failure that can taint future expectations and damage reputations.

Yet, anyone actually working within the profession can attest that these characterizations land ridiculously far from the truth. They describe a career path with near-infinite variety that can take the practitioner from the boardroom to the barnyard from one day to the next. A people-oriented but also technically challenging job that requires great skill and a deep understanding of finance and law.

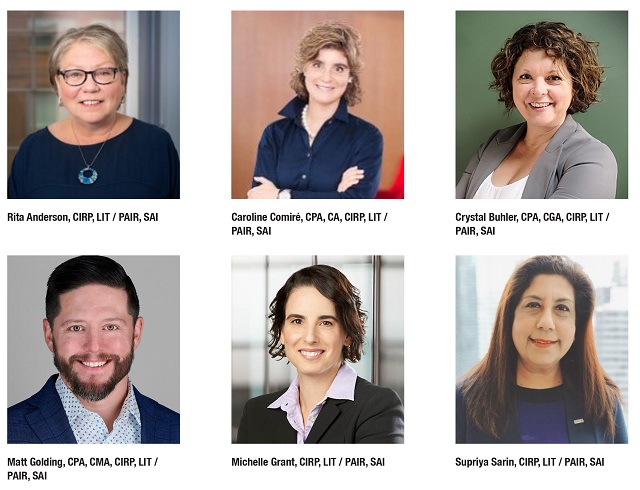

For Crystal Buhler, CPA, CGA, CIRP, LIT, president of C. Buhler & Associates Ltd., a boutique firm in Brandon, Manitoba, an insolvency career means forging a human connection more than anything else.

“It's about connecting with people and making a difference,” Buhler says. “And in accounting that's hard to do.”

Buhler, who received her CGA designation in 2004, became a trustee in 2011. She worked with Keith G. Collins Ltd. from 2004 to 2010, then MNP from 2010 to 2014, exclusively in insolvency, and from 2014 to 2016 in both insolvency and tax. She returned to Collins from 2016-2019 when she opened her own firm in 2019.

For her, working as an LIT has been notably rewarding on a personal level. Buhler says she believes there is an extra dimension to work as an insolvency practitioner “it’s the people” who are the differentiator in insolvency work.

“For every single person, even the ones who are very stoic and won't admit that this process hurts them or is impactful, you're making a difference. And some of those are the ones that you get an email from a year or two later and they're like, you know what? I just wanted you to know how much I appreciate what you did for me.”

A hidden gem in the financial sector

Many may be surprised to learn that insolvency and restructuring practitioners regard the industry as a hidden professional gem in the financial sector. The fact is, they say, there is a wide range of opportunity and experience in the insolvency industry that can be found nowhere else.

“It's so, so fun,” says Michelle Grant, CIRP, LIT, National Deals Leader for Energy, Utilities, Mining and Industrials, and a partner at PWC Canada. “We're fun. We care about a lot of things. We care about the law. We care about the outcomes. We care about people's perceptions of what we're doing.”

After 23 years in the industry, Grant understands how the negative stereotype might persist among the uninformed. She (like many in the industry) landed in insolvency more or less by accident, knowing little about careers in the area, and enjoyed it so much she has never left.

After finishing her Bachelor of Commerce (Hons) at Queen’s University, Grant wanted to become an investment banker. During job interviews following graduation, she was introduced to corporate restructuring, thought it sounded interesting, and quickly learned it was a perfect fit.

“The main thing for me is that I think this is a great, great profession. I'm so fortunate to have really stumbled into it, honestly incredibly grateful for the opportunity I was given,” says Grant. “This will be where I finish my career for sure.”

New experiences and new challenges abound

Based in Vancouver, Grant is involved in corporate insolvency, restructuring advisory, and distressed mergers and acquisition services. Her job has given her a wide array of opportunity in company turnaround, CCAA monitoring, and receivership in many industries: agriculture, food and beverage, manufacturing, mining and metals, real estate, technology and transportation.

“The value that we bring is quite significant if we're doing it right,” Grant says. “I love it, that's why I'm still doing it – it will be 23 years in September.”

And there’s always something new to test and keep the interest of even the most seasoned professional, she says. “A few months ago, for the first time in my career I was involved in a really messy shareholder dispute with a solvent business that we don't get to see normally.”

“I was using different muscles, but it was the same concept. It was like, I need to put on my mediator hat and mediate this for you. So that was really interesting. I'm doing a receivership where we're dealing with crypto assets. I've never done that. The industry has evolved, the people have evolved, the tools have evolved, and that's what keeps it fun and fresh and interesting.”

Supriya Sarin, CIRP, LIT, moved to Canada in 2005 to further a restructuring career she began in India at Ernst & Young. She too has found the profession fascinating and full of new challenges at every turn.

“When I came here, I was obviously looking for something in either the transaction space or the restructuring space,” says Sarin, “And as luck would have it, PricewaterhouseCoopers needed people on the restructuring side.”

Sarin joined PricewaterhouseCoopers’ corporate advisory and restructuring group in early 2006. One of the requirements for the job was the LIT designation, so she started the CIRP program while gaining practical work experience and achieved her LIT designation in 2011. She joined CIBC’s special loans group in 2012.

“They were looking for a person like me. It was a big jump for me at that time. Largely, I think I owe it to what I learned in the [CIRP] course and also the work experience that I got at PwC. I totally credit that because what I found that this is the one designation that teaches you very relevant stuff.”

“You have to like solving problems to really like this profession,” says Sarin. “If you do, it's a very rewarding profession, because every day it's like a different issue. When a file gets restructured and we send it back to the line of business, or when I have fully collected on a loan, that's my happy day.”

The evolution of Canada’s insolvency profession

Insolvency as a career path has undergone significant evolution in Canada since it was first addressed in the Insolvent Act of 1875, a statute largely based on English bankruptcy laws.1 The next big change came with the Bankruptcy Act of 1919, which consolidated provincial laws under a single federal framework.

The BIA’s sister legislation, the Companies' Creditors Arrangement Act (CCAA), responsible for larger corporate insolvencies, has also adapted with the times, with at least five major refreshes since its inception in 1933 in the wake of the Great Depression.

The most significant update so far has been 1985’s Bankruptcy and Insolvency Act (BIA), which provides a comprehensive framework for bankruptcies and insolvencies across Canada. The BIA has continued to evolve, but its stated purpose of giving people in financial distress a fresh start has continued to resonate across the industry.

The two acts have combined to establish the Canadian insolvency regime as one of the most efficient and effective in the world, “frequently cited as a model in international insolvency panels,” according to then-Finance Minister James Moore in a 2014 report.2

To support professionals working in the regime, CAIRP introduced in 1998 the gold standard in insolvency education, the Chartered Insolvency and Restructuring Professional (CIRP) Qualification Program as it is known today, backed by the Practical Course on Insolvency Counselling.

They are foundational to taking the Competency-based National Insolvency Exam (CNIE) which leads to the CIRP designation. An oral examination conducted by the Office of the Superintendent of Bankruptcy (OSB) is required to become a Licensed Insolvency Trustee (LIT).

The CIRP designation: a gateway to many opportunities

In Canada, almost all formal insolvency proceedings, such as consumer proposals and bankruptcies, must be administered by an LIT. Most Canadians will never meet an LIT, and most of those who do will likely be dealing with a personal insolvency.

In no other part of the insolvency profession do people skills matter more – far from a dry office job sifting through figures and balance sheets, being a trustee means connecting with people during what may be the worst time in their lives, according to Rita Anderson, CIRP, LIT, who operates a successful practice in Sydney, N.S.

“When you're dealing with people, you're dealing with huge emotion,” Anderson says. “I used to take it home and it used to bother me but now it doesn't, because at the end of the day, I am the trustee that will sit down and I could talk to anybody, whether it be the fishermen at the wharf or the surgeon.”

“Probably the way I'm going to retire is when I'm in a box,” says Rita Anderson. “Because when you love what you do, how do you walk away from it?”

Anderson began working in Sydney in 1987 for Collins Barrow (which became part of PwC), and she was “lucky enough to be able to get my hands into everything” from consumer to commercial files as a trustee. In 2015, she struck out on her own, grateful for the range of experience working at a firm had given her – experience that gave her the confidence and know-how to run a thriving business that mainly handles consumer files.

“I run my own boutique firm,” says Anderson. “This career has done so much for me in my life. It's not just doing what you do for your client, what it has brought me is that when I have conversations with people, I look at them differently than I did beforehand. There is not a file, not an individual, not a day that's the same. You're not going to be bored, it’s as simple as that.”

“Being with people during what can be a dreadful and emotional experience for some can be incredibly poignant,” says Buhler. “As much as you don't take your work home with you, if a person’s hydro is getting cut off tonight and you were able to resolve that or fix that, that feels good.”

There’s also a very serious side to being involved with ordinary people facing extraordinarily distressing times, she adds, and it’s a common experience among many LITs who handle personal bankruptcy.

“Multiple times we've all sat with somebody who's been, you know, I'll say just suicidal, just really in a rough spot. And we've been able to work them through,” says Buhler. “Then a year later they're sending us pictures of their kids and their grandkids, and we're just like, yes! You were there to see that! There's no monetary value you can put on that.”

In very few other careers will you have to sell a giraffe

This insolvency and restructuring profession offers a lot of variety and adventure, and can be both challenging and rewarding.

How challenging and rewarding?

“I once sold giraffes,” says Caroline Comiré, CPA, CA, CIRP, LIT, BDC’s Québec Business Restructuring team director. “I was a receiver working with a zoo. Our work takes us from construction sites to designer boutiques. It takes us out of the defined sandbox and it’s fun.”

“I've been working 20-something years and I'm still learning stuff. It’s always interesting. I think it's the diversity that makes a difference.”

If you want to gauge just how diverse one file can be from the next, the BDC team’s Atlantic director Matt Golding, CPA, CMA, CIRP, LIT, offers up his strategy – and a fitting metaphor – for dealing with the range of companies and businesses he might need to visit.

“I have specialized shoes in my garage that are in three bags that I wear, depending on what file I go to,” says Golding. “Rubber boots, construction boots and nice leather dress shoes -- you don't want to wear dress shoes to a hog farm, I'll tell you that.”

Passion, learning, and the magic of the profession

Insolvency professionals almost universally love their jobs – they speak of it as a great passion, talk about dedication and how much personal satisfaction they gain.

One thing that separates the insolvency field from many other in the financial world is its immediacy, Golding says.

“If you're in audit, for example, you're going to be doing inventory reconciliation, looking at numbers that happened six months ago and forming an opinion on it,” he says. “This is accounting, but it’s real time accounting. This is what's going on right now.”

“Curiosity and a desire to learn, to understand the companies that appear in a file, are absolutely essential to insolvency work,” he adds. “You've got to have that desire to want to learn. And if you do, it's a job that is difficult and is challenging, but it is very rewarding. If you are driven, this is a great career path. It gives you an opportunity to build skills across any portfolio. But it also gives you a chance to talk about a lot of different industries.”

“Maybe that's the magic about this profession is that it's this little sort of undiscovered garden of delightful stuff that you never thought you'd do,” says Grant. “It's got so many facets to it -- it's got legal, accounting, finance, it's all forensic.”

“It's got the makings of a really suspenseful novel all the time. That's the best way I could describe it, as if you're kind of page-turning through your life.”

1 https://law.uwo.ca/conferences/archives/bankruptcy_2021/100%20Years%20of%20Bankruptcy.pdf

2 https://ised-isde.canada.ca/site/corporate-insolvency-competition-law-policy/sites/default/files/attachments/review_canada_insolvency_laws-eng.pdf