CAIRP: Q3 Canadian Insolvency Statistics

TORONTO – November 9, 2022 – The latest statistics released by the Office of the Superintendent of Bankruptcy find consumer insolvency filings in Canada rose 22.5 percent in the third quarter of 2022 compared to the same quarter last year, the largest percentage increase in 13 years. Consumer insolvencies increased 2.3 percent compared to the second quarter of this year, as the number of filings continues to inch back up towards pre-pandemic levels. As more Canadians file insolvencies, the Canadian Association of Insolvency and Restructuring Professionals (CAIRP) is urging Canadians experiencing personal financial challenges to speak with government-regulated licensed professionals, as some unregulated debt advisory firms have been observed misrepresenting the services they offer and misleading insolvent individuals to pay unnecessary fees for debt-relief.

“The concern is that more Canadians are reaching their breaking point financially, and as many desperately search for solutions to their debt problems, they may be lured by unrealistic promises to quickly solve their debt problems or fix their credit score,” says André Bolduc, Licensed Insolvency Trustee and Vice-Chair of CAIRP, the national voice on insolvency matters in Canada. “Unfortunately, those promises can end up being too good to be true.”

In the third quarter of this year, 25,860 Canadians filed a consumer proposal or bankruptcy. Consumer insolvency filings in Q3 are 24.9 percent higher compared to the same quarter of 2020, yet filings are still 25.5 percent lower than pre-pandemic levels in 2019. For the 12 months ending September 30, 2022, consumer insolvencies are up 5.9 percent, compared to the previous 12-month period.

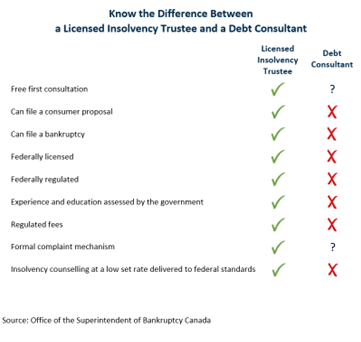

As part of Financial Literacy Month 2022, The Office of the Superintendent of Bankruptcy (OSB) and the Canadian Association of Insolvency and Restructuring Professionals (CAIRP) are working together to help Canadians find advice and solutions they can trust to help with their debt. They are urging Canadians to beware of unregulated, unlicensed debt advisors that claim to be authorized to assist with insolvency options. Some charge hundreds or even thousands of dollars for services they are not licensed to provide, or for unnecessary services offered before, during or after a consumer proposal or bankruptcy filing.

Anyone considering a consumer proposal or bankruptcy should meet with a Licensed Insolvency Trustee (LIT) first. LITs provide independent, unbiased advice about the options to deal with debt and they are required to discuss all options available for solving financial difficulties, including insolvency and non-insolvency options. Typically, initial consultations with LITs are free, so those facing debt problems can get advice with no commitment and no upfront fees.

“Canadians can feel confident that when they seek advice from a Licensed Insolvency Trustee, they are dealing with someone who has demonstrated they have the knowledge, experience and skills to help them make informed choices to deal with their debt. They are the only debt-relief professionals in Canada legally required to offer a complete financial assessment, explain all the options for debt-relief and offer unbiased advice,” says Jean-Daniel Breton, Chair of CAIRP.

Those struggling with debt have three main options: They can obtain relief through bankruptcy; formulate a consumer proposal; or seek debt counselling. Licensed Insolvency Trustees take a customized approach to help people make the best decision to deal with their debt based on their circumstances. For individuals in significant financial difficulty, a consumer proposal or bankruptcy may be the best solution.

“The stigma of bankruptcy prevents many from seeking the advice of a Licensed Insolvency Trustee. In actuality, we can offer options for insolvent consumers to avoid bankruptcy by negotiating an agreement with creditors to reorganize their financial affairs. This process, called a consumer proposal, can only be done by speaking with a Licensed Insolvency Trustee,” says Breton. “LITs may recommend non-insolvency options such as talking to your creditors, consolidating your debts, establishing and following a budget or a Debt Management Plan (DMP). If needed, they can refer you to a reputable credit counselling agency to access DMP services, for example.”

Third-quarter business insolvencies are up 48.5% over last year, the largest percentage increase in 35 years of records.

There were 796 business insolvencies filed in Q3, with the number of filings remaining stable compared to the previous quarter. However, new business insolvency filings are 48.5 percent higher than in the third quarter of last year, which represents the largest percentage increase seen in 35 years of records. For the 12 months ending September 30, 2022, business insolvencies are up 29.7 percent, compared to the previous 12-month period.

Jean-Daniel Breton, Chair of CAIRP, explains that while those statistics represent businesses that have filed for bankruptcy, there are likely more who have chosen to simply close their doors and walk away from their businesses. He says business owners may not realize there could be options available to help rehabilitate their business, including restructuring.

“When a business is struggling with debt, the best recourse is to speak with a Licensed Insolvency Trustee. They can assess the unique financial and operational aspects of the business to provide advice that can help make the business viable again, and assist the business owners in developing a restructuring and recovery plan that addresses the needs of all stakeholders,” says Breton. “Or if the business is burdened with debt and no longer viable, they can offer options to formally wind down the business and will handle the liquidation process while ensuring a balance between the rights of the creditors and the debtors.”

The sectors registering the biggest increase in the number of insolvencies for the 12 months ending September 30, 2022, compared to the previous period were accommodation and food services, and construction. The biggest decreases were seen in the mining and oil and gas extraction, and finance and insurance sectors.